University operations are organized into Organizational Units that develop and execute strategic

and tactical plans to carry out the University’s mission and achieve its objectives. These units

obtain and utilize resources, the financial impact of which is accumulated and summarized in the

University’s financial records. Financial records are an important management tool, used to both

measure and monitor the acquisition and use of resources.

Sound financial management practices, the State of Colorado statutes and fiscal rules, and

federal regulations require the University to implement fiscal policies and procedures that:

- -Reasonably ensure the fiscal impact of University operations is planned, controlled, and accurately accounted for in the University’s financial records;

- -Reasonably ensure Fiscal Transactions comply with applicable policies, laws, regulations, and rules; contracts, grants, and donor restrictions; and generally accepted accounting principles; and

- -Require an Internal Control environment to accomplish the above two objectives.

This policy statement establishes the Fiscal Roles and responsibilities of Employees by providing

additional clarification and guidance regarding the framework within which financial

management occurs. Accordingly, this policy applies to all University funds and to all

Employees.

Policy Statements

The University has a fiduciary responsibility to fulfill its overall mission ethically and in

compliance with applicable policies, laws, regulations, and rules, and contracts, grants, and

donor restrictions. Accordingly, the University is obligated take reasonable actions to ensure

that:

- -University funds are used only for official University business;

- -University funds are accounted for accurately in the University’s financial records; and

- -The University maintains Internal Controls, which strive to accomplish the following objectives:

- -Protection of assets, such as facilities, data, equipment, supplies, inventory, accounts receivables, and cash (including checks and credit card payments), from unauthorized access or theft;

- -Adequate authorization and record-keeping procedures to achieve accuracy and reliability of accounting data and other management information;

- -Promotion of operational efficiency and effectiveness;

- -Reasonable compliance with all applicable policies, laws, regulations, and rules, as well as contracts, grants, or donor restrictions;

- -Proper segregation of duties so that no one controls all phases of a transaction (except, in rare instances, where a waiver of segregation has been granted in writing by the appropriate campus Controller due to the implementation of adequate compensating controls); and

- -An effective process of continuous assessment and adjustment for any changes in conditions that affect the Internal Controls.

To facilitate the successful fulfillment of this obligation, all Employees are required to:

- -Complete, within a reasonable time frame, the training program provided by the University on the types and hierarchy of the Fiscal Roles and responsibilities defined in this policy;

- -Carry out the fiscal responsibilities, as defined in this policy, of their assigned Fiscal Roles; and

- -Comply with the following interrelated Administrative Policy Statements:

- -Controller Function Decentralization

- -Fiscal Code of Ethics

- -Officer Disclosure of Interests

- -Fiscal Certification

- -Fiscal Misconduct Reporting

Fiscal Roles

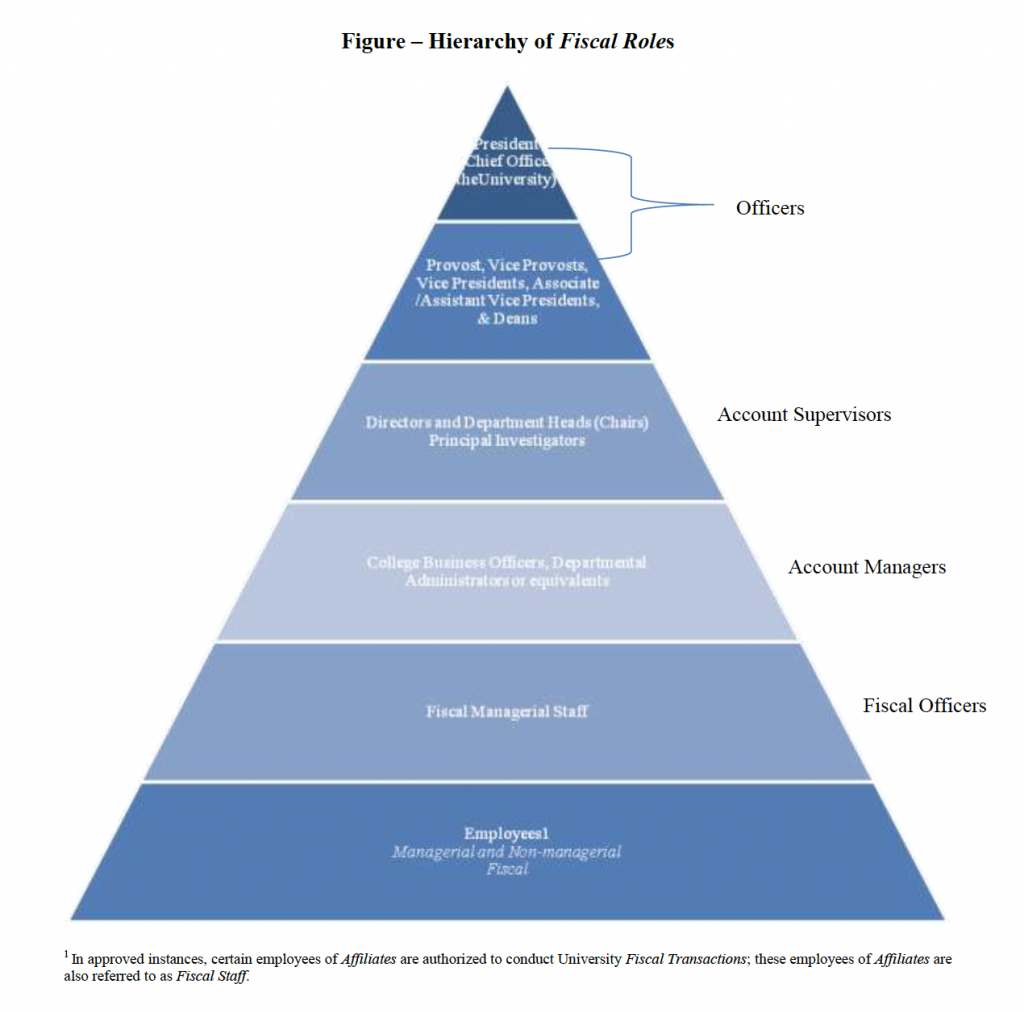

The following figure illustrates the types and related hierarchy of Fiscal Roles within University

management.

Officers

The term Officers refers to the President, other Officers of the University, and Officers of the

Administration.

President: The President is the chief Officer of the University responsible for compliance of all

University fiscal matters with applicable policies, laws, and regulations.

Officers of the University: Other Officers of the University include the secretary, treasurer, and university counsel.

Each of these positions has specific functional reporting responsibilities to the Board.

These positions are entrusted with fiscal responsibility to the President for their assigned

Organizational Units as well as for their Functional Area of Responsibility.

Officers of the Administration: Officers of the Administration are those individuals who hold the title or interim/acting title of vice president, provost, associate vice president, assistant vice president, vice

provost, associate vice provost, associate university counsel, and deans of the schools,

colleges, and libraries. Further, on written request, the President may designate other

Officers of the Administration, which will be recorded in the respective letter of offer and

also in the University’s official personnel roster. A current listing of Officers of the

Administration may be found at {insert weblink}. These positions are entrusted with

fiscal responsibility to the President or appropriate organizational supervisor for their

assigned Organizational Units as well as for their Functional Area of Responsibility.

Within the Officers of the Administration, the President has delegated to the positions of

Vice President of Finance and University Controller the overall staff responsibility for the

development and implementation of the financial management guidelines. Specifically,

as detailed in the Administrative Policy Statement, Controller Function Decentralization,

the University Controller has the authority over and responsibility for the compliance

with University fiscal policies, external fiscal rules and regulations, and generally

accepted accounting principles.

Account Supervisors

Department Heads (or equivalent position titles) are the principal administrators of the school or

college’s departments, and are accountable to the Deans. Directors (or equivalent position titles)

are the principal administrators of Organizational Units, such as institutes, centers, and

administrative departments, accountable to an Officer of the Administration (or other Fiscal

Principal). With these appointments, Chairs and Directors (or equivalent position titles) are

entrusted with fiscal responsibility for their assigned Organizational Units.

Under federal regulations, each Sponsored Project has an identified Principal Investigator or

faculty member charged with the responsibility for the administration and fiscal oversight of the

Sponsored Project. With these appointments, Principal Investigators (or other faculty members)

are entrusted with fiscal responsibility for their assigned Sponsored Project.

Kuali Role: To emphasize the fiscal responsibility, these positions are designated as Account

Supervisors accountable to the designated Officer (or other Fiscal Principal). These

individual provide a leadership role as a supervisor in providing oversight for account

management at a higher level than the fiscal officer, but rarely receives any direct requests

for action from the Kuali Financial System. Account supervisor cannot be the same as the

fiscal officer or the account manager.

Account Managers

Facilitates the accomplishment of financial management objectives, an Officer or, where

delegated by an Officer or Account Supervisor, may designate employee(s) within the Officer’s

Functional Area of Responsibility (such as Departmental Administrators or other position titles)

as key employee(s) with the authority and responsibility for Fiscal Transactions. To emphasize

the fiscal responsibility of these positions, these positions are designated as Account Managers.

Kuali Role: This is an operation role which has responsibility for ensuring that funds are

spent and managed according to the goals, objective and mission of the organization, to

ensure that the funds are being spent according to a budgeted plan and that the allocation of

expenditures is appropriate to the function identified for the account. Fiscal Officer and

Account Manager may be the same individual.

Fiscal Officers

Within Kuali, Oversight role assigned at the account level which must be an individual, not a

workgroup. Each document requires a Fiscal Officer approval. Fiscal Officers may delegate

approval authority to a single primary delegate or to multiple secondary delegate(s). The

delegation may be for all document types, or only specific document types. A dollar range

(minimum, maximum) may also be designated and the delegation may be for a specific

period of time (annual leave, etc.). When delegations are in place, the Fiscal Officer and delegates may need to apply a filter to retrieve the documents they have authority for.

Fiscal Staff

Many other Employees of the University are involved in University Fiscal Transactions, such as

initiating purchases, receiving cash or other negotiables, entering or reviewing transactions into

the University’s Finance System, monitoring contractors, or verifying compliance. These

Employees are referred to as Fiscal Staff. In addition, in approved instances, certain Employees

of Affiliates are authorized to conduct University financial transactions. These Employees of

Affiliates are also referred to as Fiscal Staff.

All other Employees are hereafter referred to as Non-Fiscal Employees in this policy.

This web page has been adapted from: http://kuali.colostate.edu/documents/FiscalRole.pdf